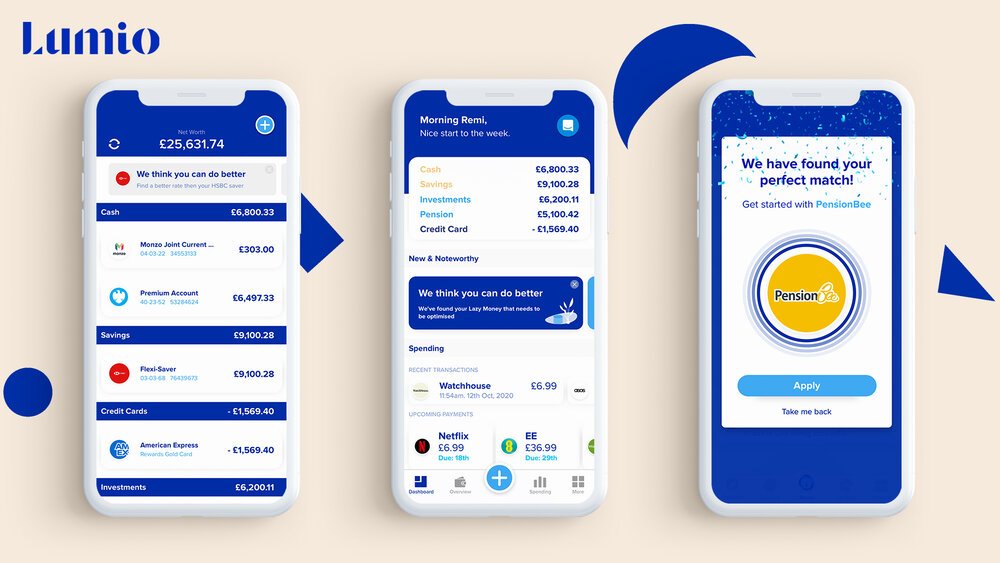

Powered by Moneyhub’s Open Finance Data & Intelligence API and Payment API, the Lumio app gives customers a full view of their finances, optimising and growing their money on autopilot to enable financial freedom

The Lumio App is a ‘personal finance brain’ that connects a customer’s financial life in seconds - and grows their money on autopilot. With over 20,000 financial accounts already connected from over 100 providers, over 100 million transactions analysed, and more than 8,600 customers on iOS & Android - a figure that is growing 94% monthly - Lumio are on a mission to help 1 million customers grow their money by 2024. Lumio has helped their customers discover products that will grow their money faster on more than 3,000 different occasions, including savings accounts, robo advisors, mortgages and investment platforms.

Founded by Charlie Richardson, Adrian Shedden and Tom Richardson, Lumio stands apart from competitors like Yolt, Emma and Money Dashboard with its unique automated financing engine that lets customers connect their entire financial lives, whilst matching them with the right product at the right time, and setting up automatic transfers to grow their money on autopilot. So how did it all begin?

Challenge

Lumio noticed that money is ‘Lazy’. And they noticed it’s everywhere - think useless savings rates, extortionate investment fees and high-interest credit and loans, often maintained by ‘Lazy’ Advisors, ‘Lazy’ Comparisons and ‘Lazy’ Products.

Lumio’s research identified a huge market opportunity, showing £176bn of ‘Lazy Money’ depreciating in the UK, with an estimated £33bn added to that pile every year. And beyond the UK, a massive £10tn of ‘Lazy Money’ exists across Europe - all just waiting to be optimised. Wealthy individuals may have the right resources to fully optimise their finances, but Lumio embarked on a mission to give everyone access to financial security, and the peace of mind to decide upon their own financial future.

Solution

The Lumio app was concepted and born. Designed to enable financial freedom and help customers achieve their goals and aspirations, the app was created to be seamless, easy-to-use and independent, acting solely in customers’ best interests and automatically finding clever ways for customers to grow their money.

Lumio needed customers to be able to connect accounts in seconds to instantly start tracking, planning and growing their full financial life, without changing their lifestyle. To do this, Lumio required two APIs - one to connect customers to their financial accounts, and another to facilitate account-to-account payments - both of which Moneyhub provides. Furthermore, Moneyhub is on a mission to power innovation for the greater good and help everyone achieve Financial Wellness. This alignment of core values - along with Moneyhub offering the most comprehensive Open Finance data aggregation source on the market - meant partnering with Moneyhub was the obvious choice.

“We want Lumio and its stakeholders to play their part in building a world where everyone has the financial security and peace of mind to decide their future. Moneyhub’s mission and values are completely aligned with what we expect from ourselves and our partners as we push for truly Open Finance that serves everyone.”

Moneyhub’s Open Finance Data & Intelligence API enables Lumio’s customers to connect to thousands of financial institutions globally, from bank accounts, mortgages, savings and loans, to investments, pensions and credit cards. This gives Lumio customers an overview of not only their banking data, but also their entire financial universe. Moneyhub’s spending analysis and data categorisation engine unlocks unique and holistic insights into their financial habits, behaviours and aspirations, which enables Lumio to make suggestions on savings and investments based on the individual's needs.

Furthermore, Moneyhub’s Payment API facilitates account-to-account payments in a compliant way, without the hurdles of Lumio having to obtain their own AISP and PISP licences. By using Moneyhub’s full suite of Open Finance APIs, the most comprehensive Open Finance data source on the market, Open Banking and P2D2 compliance were assured. Choosing to use Moneyhub’s APIs rather than building and maintaining thousands of financial data connections themselves allowed Lumio to reduce development costs and launch the app to market quicker.

“The breadth of Moneyhub’s comprehensive financial data source and expertise made them the obvious choice. We didn’t just want to offer our users access to their banking data but also provide a holistic view of their financial situation so they could make informed decisions and secure better outcomes by using our app. With Moneyhub we are able to offer our users this and more!

Working with the Moneyhub team has been a truly collaborative experience. Tapping into their expertise and working directly with their development team enabled us to build out the proposition which suited our specific needs.”

So what does the future hold?

Lumio began an energetic fundraising drive in early 2021, crowdfunding an incredible £1.15m in 2 weeks on Crowdcube, being over 450% oversubscribed and vastly exceeding their initial £250,000 target.

Recognised as part of the top 100 Fintech Disruptor by BusinessCloud in 2020, ahead of Monzo and Seedrs, with coverage from AltFi, the Fintech Times, Forbes, Tech Nation and Sifted by FT, the funding will be used to power their mission of growing 1m customers' money by 2024 - accelerating financial independence and personal progress through intelligent technology. Lumio plans to expand into Ireland soon, and are building the foundations for key mainland EU jurisdictions for a launch in early 2022.