Variable recurring payments. Empowering the customer through open banking payments

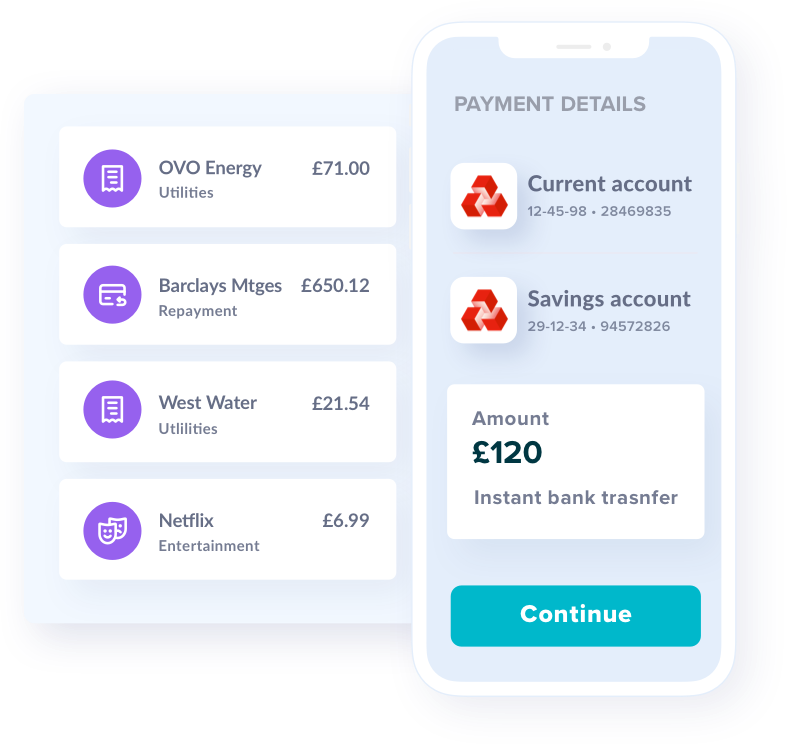

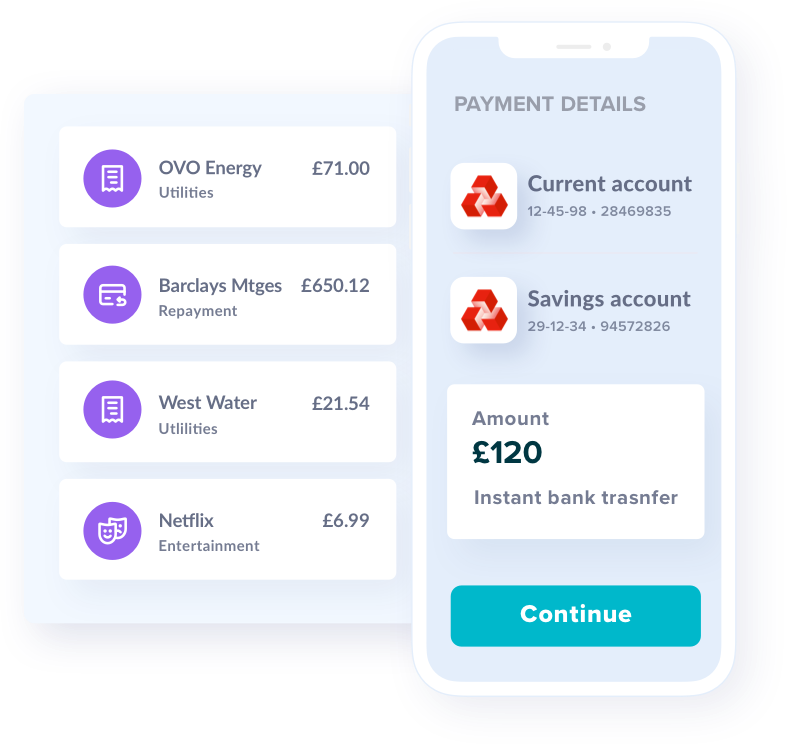

Using built-in rules, move money between accounts for better cashflow and improved customer control over when a payments is made.

Using built-in rules, move money between accounts for better cashflow and improved customer control over when a payments is made.

Customer have more control over the timing of payments as well as the amount which creates more transparency than existing regular payment alternatives.

Move money in between two of one’s own accounts. This has the potential to be a replacement for Direct Debit or holding a ‘card on file’ with a Continuous Payment Authority.

Use non-sweeping or commercial VRPs, to offer an alternative to Direct Debit which is embedded into a wider range of customer journeys. It has countless applications, including utilities, subscription services, retail and financial institutions.

Automate variable payments for gas, electricity and water

Move surplus money automatically between a customer’s current and savings account or credit card for better financial wellbeing

Customer can set a time limit to cancel a trial after amount of months in order to avoid subscription traps

Whether you want to create your own solution, or you want us to do it for you—we have the technology for it. Our experienced payments team is here to support you now and in the future.

Whether you want to create your own solution, or you want us to do it for you—we have the technology for it. Our experienced team is here to support you now and in the future.