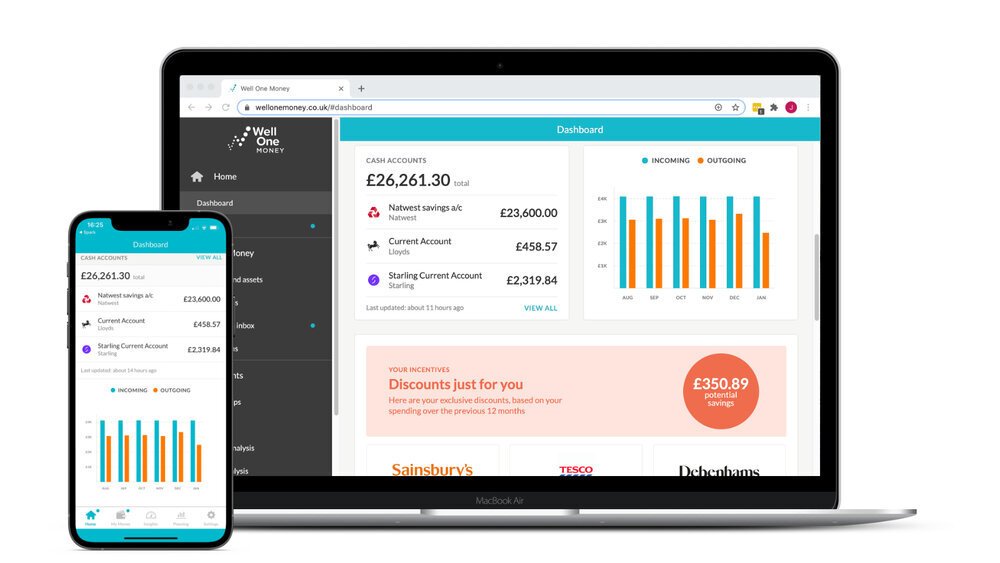

Collaborating with AON to create the ‘Well One Money’ financial wellbeing app, to help employers support employee financial wellbeing - saving employees an average of £850 per year¹

Aon is a leading global professional services firm providing a broad range of risk, retirement and health solutions to employers. Its 50,000 staff in 120 countries empower results for their clients by using proprietary data and analytics to deliver insights that improve staff wellbeing and performance.

Challenges

Aon set out to answer three key challenges being faced by their clients, and their clients’ employees:

Challenge 1: Help employees improve their financial wellbeing

A tool was needed to give employees a true, complete view of their financial situation (not just limited to bank accounts), enabling them to holistically view their entire financial world to aid better understanding, in order to improve overall financial wellbeing. The proposition was to be developed as an extension to their ‘Well One Money’ app.

Challenge 2: Increase employee engagement

It’s often said that the first step to financial wellbeing for a user is engagement in their own personal finances - but this is where things often fall down. AON wanted to tackle this engagement challenge head on, and help employers improve staff productivity and engagement, manage churn and attract talent. Aon needed to better understand their users’ financial pain points - and this required a much broader financial data set beyond current accounts.

Challenge 3: Drive awareness and use of Aon Plus

‘Well One Money’ users also have access to ‘Aon Plus’ - a retail discount programme that understands employees’ spending patterns and identifies potential savings that can be made instantly. It offers hundreds of promotional discounts from participating retailers and restaurants. Many employees missed out on savings, as they had to proactively research them. To increase awareness of its offers, Aon needed a simple and effective solution to promote Aon Plus savings.

Solutions

Moneyhub and AON worked together to solve each challenge head-on:

Challenge 1: Help employees improve their financial wellbeing

Solution: Create Well One Money

Harnessing the power of Moneyhub’s award-winning Personal Financial Management (PFM) platform, AON and Moneyhub created the bespoke white labelled offering ‘Well One Money’.

The app highlights day-to-day income and spending flow against a backdrop of debts and long term savings, including pensions. Removing barriers such as multiple platform logins across different providers means employees can, for the first time, quickly and simply view pension contributions and investment performance in the context of their overall net worth.

The app eases the burden of financial admin - connecting pensions, savings, investments, loans, mortgages, cards, bank accounts and even properties into one easy to use place. With an array of additional features including account aggregation, spending analysis, financial forecasting and personalised nudges, the data-driven ‘Well One Money’ platform puts users in control of their own finances, encouraging them to make better savings choices as a result. Users get a view of not only their current wealth, but also their future wealth - a unique combination that can greatly improve financial wellbeing, and ultimately create happier employees.

Challenge 2: Increase employee engagement

Solution: A better understanding of the employee

Taking advantage of Moneyhub’s Analytics and Insights, Aon’s clients can benefit from an anonymised view across their employee base to understand financial habits, needs, behaviours and aspirations. By knowing their employees’ financial concerns, employers can proactively support them.

In practise, this gives not only context, but also enables timely, relevant communications. For example, if a large proportion of the workforce is in debt (possibly reducing productivity), focussing communications on pension provision is not helpful for an audience that needs help with debt reduction more imminently. With this knowledge, Aon can help its clients to guide their employees, prioritising their efforts around benefits and culture, so they can influence workforce productivity and increase employee engagement.

“Well One Money is helping our clients save money every day- making a tangible difference to their financial well-being. Our employers too have benefited from this offering. More and better data means they can better engage with their employees, help to reduce their stress and in doing so improve productivity. Focusing on our financial wellbeing proposition, and using Moneyhub as an Open Finance platform to do so, has been a win-win for everyone”

Challenge 3: Drive awareness and use of Aon Plus

Solution: Seamless integration

Aon utilised the flexibility of the Moneyhub platform to seamlessly integrate their existing retail offers. Moneyhub's award winning Data Enrichment Platform and AI and machine-learning powered Categorisation Engine analyses a user’s spend at different retailers across the accounts they have connected. Users are then presented with the value that they could have saved over the last 12 months - plus the amounts they could have saved for each of the three retailers with the highest potential savings - along with a seamless purchasing journey. This information is updated each time the user logs in, ensuring that the offers stay up to date, tailored and relevant.

“Working with Moneyhub has enabled us to offer our client’s employees a truly elevated experience, empowering them to manage their money more effectively and make the most of the benefits we offer. When we approached Moneyhub we knew that we needed to work with a platform that could provide our users oversight of their whole financial universe and we found that, and more, with Moneyhub.”