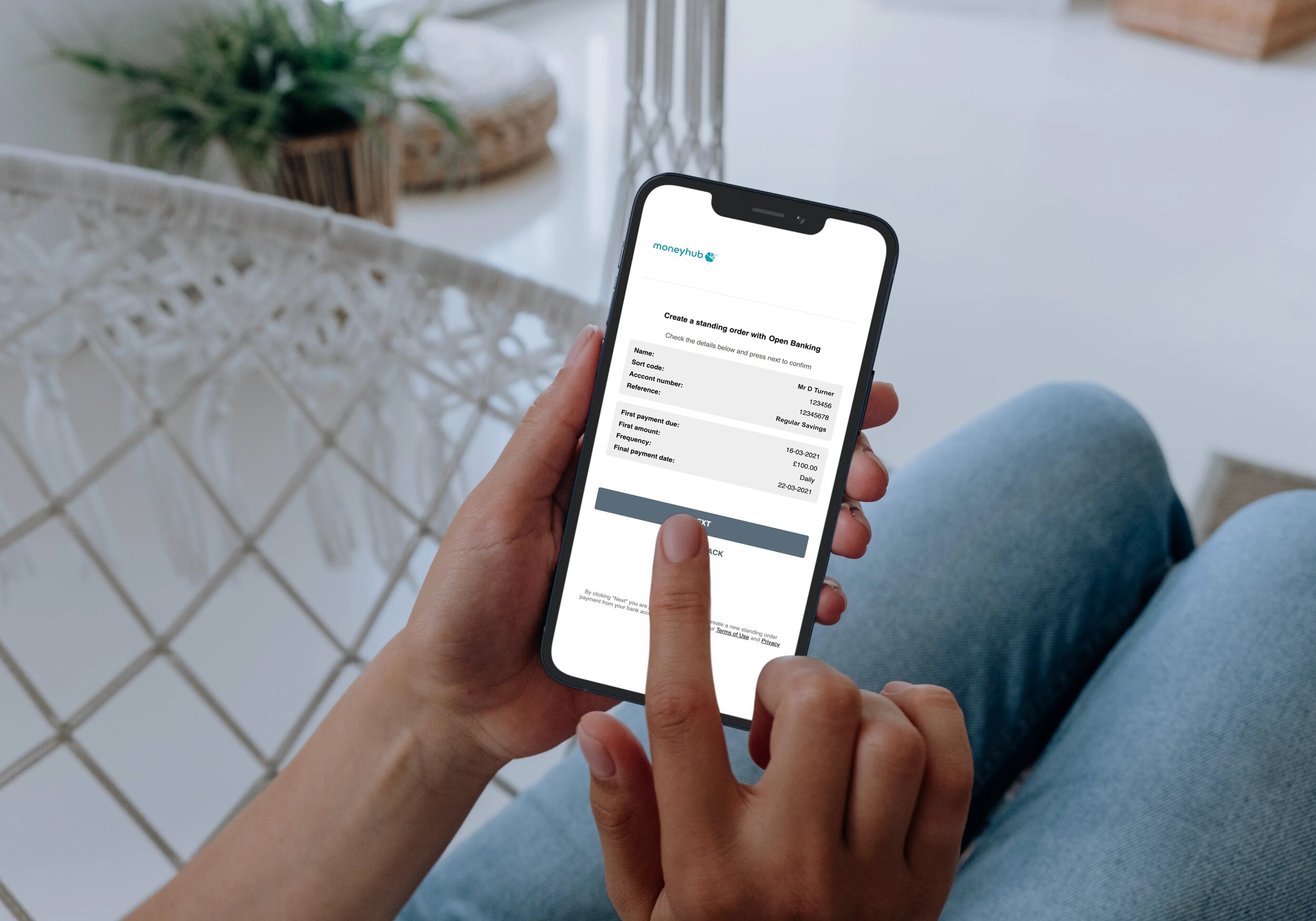

Standing orders have many use cases for your customers. They are the cheaper, faster and more secure way to make a Fixed Recurring Payment - and are just one of many features available through our Payment API.

What is a Standing Order?

Standing Orders are recurring scheduled payments for the same amount, with a frequency you choose, which are often used to pay for things such as rent, mortgage or any other fixed regular payment into savings, pensions or investment accounts. They can be executed to make automated payments either daily, weekly, monthly, or on another fixed schedule of your choice.

“Standing Orders are set up and controlled by the end user, giving consumers more visibility, and more control over making changes. ”

Using Open Banking payments, which allow a customer to transfer money from one bank account to another, Standing Orders are usually processed and received on the same day they are sent. As they are based on the same Faster Payments infrastructure used in current bank transfers, most Standing Order payments should be made almost immediately, if both accounts are part of the Faster Payments Scheme.

Benefits to customers

Standing Orders are set up and controlled by the end user, giving consumers more visibility, and more control over making changes.

Standing Orders are also a cheaper, faster and more secure way to make a Fixed Recurring Payment. There is no mandate to sign, no complicated guarantee to understand, and no card number to give away and be stored. Due to this, Standing Orders make a great alternative to ‘card on file’ or paying via Direct Debit. Direct Debits are set up by the end merchant, whereas Customers are also able to set a unique reference for each Standing Order to make it easy to reconcile the incoming payment when viewing their transactions.

“Standing orders can be set up to donate regularly to your chosen charity and these can be amended over time to change the amount of the donation and frequency at no cost to you or the charity. ”

Some Standing Order use cases

Topping up savings and investments

A Standing Order is ideal for recurring account top-ups. The customer can ensure they are regularly added to a savings, investment or pension account that aligns to when they receive their salary each week or month. If a customer’s circumstances change - such as changing jobs or receiving a pay rise/cut - they can change the standing order instantly, without the fear of incurring any fees for cancelling or amending.

Paying personal bills of a fixed amount

Standing Orders can be used to pay recurring household bills that are unlikely to change in cost each month - such as water, phone and broadband, or even rent or mortgage. For tenants living in a shared house, if one person pays a bill directly, Standing Orders from all tenants into the payer’s account for their portion of the payment can be a helpful way for customers to keep on top of who owes what.

Business expenses, overheads and customer payments

The cost of setting up and using Standing Orders for regular payments is low, meaning a business can efficiently stay on top of their costs. Some small businesses also collect regular payments from customers by Standing Order knowing that payments will be collected automatically and on time.

Paying for subscriptions

Many people have subscriptions for magazines, food boxes, software or streaming services like Netflix or Amazon Prime, which charge a fixed fee on a monthly basis. A Standing Order can be the perfect option to pay these, as the Standing Order can be cancelled or modified by the user, rather than having to contact their bank to cancel a Direct Debit, for example.

Charitable organisations

Standing orders can be set up to donate regularly to a chosen charity and these can be amended over time to change the amount of the donation and frequency at no cost to the customer, or the charity. This is especially important in the post-Covid world, where 53% of charities reported a drop in donations since the start of the crisis (source: CAF UK Giving Three Month Coronavirus briefing).

How can I get started with Standing Orders using Moneyhub’s Payment API?

Standing Orders are just one of many features you’ll receive as standard with our Payment API. Visit our Standing Order documentation to start building, or get in touch to find out more.

Author

David Turner

David is Moneyhub’s API, Payments and Connections Product Manager and is responsible for delivering new features for our API platform to enable fintechs and larger firms to build amazing customer experiences. He works with our existing clients to understand their needs so they can deliver more for their clients, and aims to continually improve our market fit to grow our customer base. David has over 10 years’ experience in Financial Services in project delivery, IT Operations and product ownership roles.In all his roles, David’s key focus has always been ensuring the technology solutions deliver fantastic and resilient outcomes.