Two years ago, something pretty special happened in the world of payments. At the Altus Platform Efficiencies Event on 19 September 2018, Moneyhub COO Dan Scholey facilitated the first ever Open Banking payment by a member of the public, live, using payment initiation services (PIS) - resulting in an instant direct, bank to bank payment. Fast forward two years (almost to the day) and we’re thrilled to launch another world first, with our Open Banking powered QR code payments with Gift Aid.

The progress of payment initiation services

Since 2018, tens of thousands of payments have been made using PIS, and connection speeds have got significantly faster. Big banks have started to embrace Open Banking (we do have to highlight that some have done a better job than others), while at the same time we have seen the rise (and occasional spectacular fall) of challenger banks that offer more control and flexibility over our money.

Then, of course, Covid-19 fundamentally changed how we live, shop and work, and safer, cleaner payments for goods and services have become important in ways that none of us could have predicted.

Proximity payments

The pace of change in the world of payments will no doubt continue unabated. What have we got to look forward to over the next two years? At Moneyhub our technology is driving huge changes in the way people and businesses make and receive payments. For example, we’ve recently partnered with Roqqett who use our Open Banking Payment API to initiate payments, so shoppers and diners can pay directly from their bank accounts at the point of purchase. This saves money for businesses who avoid traditional transaction fees from card providers, and enables truly contactless, socially distant payments. In the broader context of Open Finance, our partners like Pollen Street Capital make SME loans less complex using Open Banking Payment, so the organisation receives their funds faster and at a lower rate. Several other clients like Lumio and OpenMoney are cashing in on the return of long term savings - and it’s understandable, with the easy, financially viable payments that are now available.

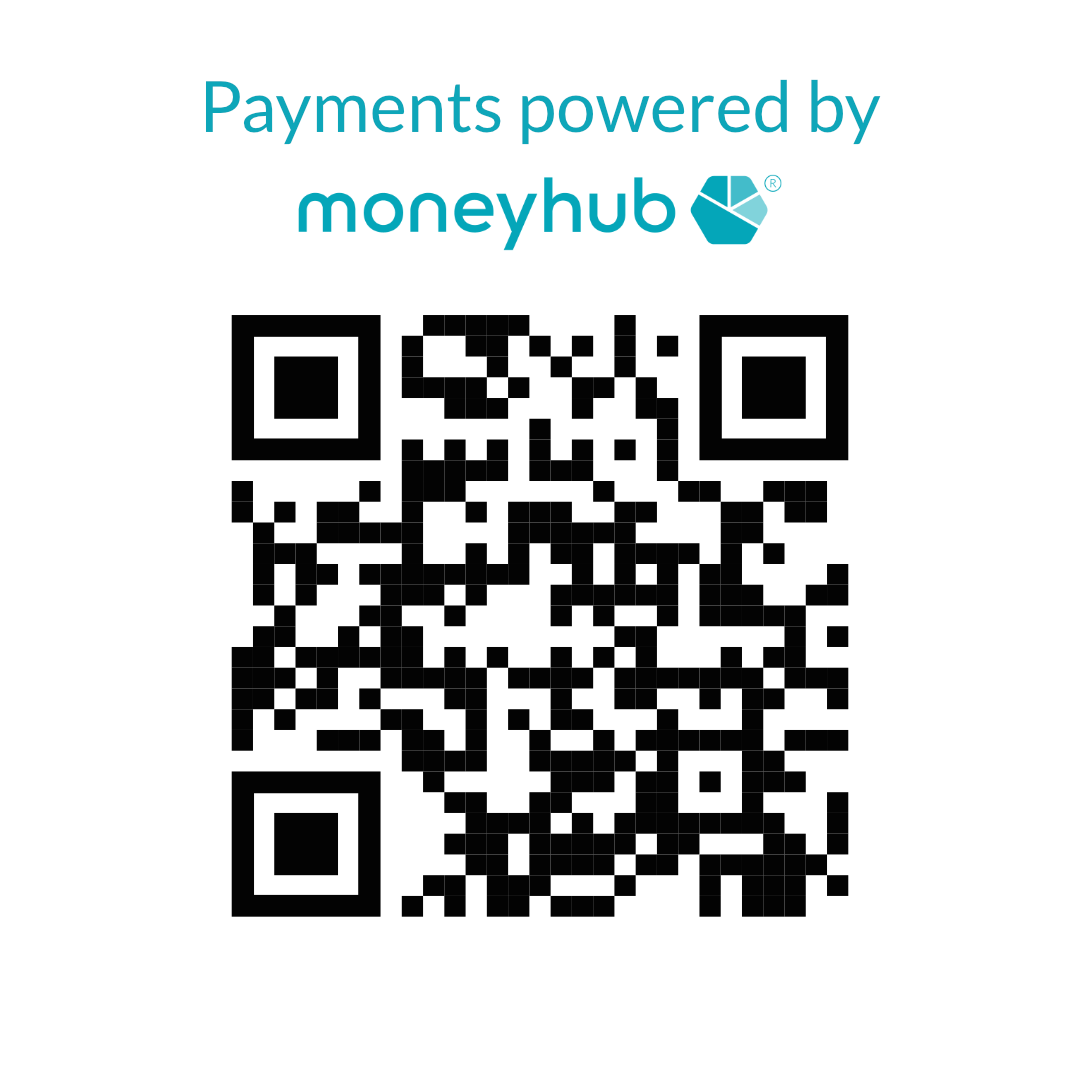

Fast, easy ‘proximity payments’ like this are useful for so many different organisations. Just this week, we launched the world’s first Open Banking powered QR code payments with Gift Aid, specifically to benefit charities (who have been impacted so greatly by the pandemic). People aren’t carrying cash much these days, but a QR code on the side of a collection bucket or Big Issue Magazine (yes, we’re enabling them too) can initiate a contactless payment directly from one bank account to another account.

The benefits to charities are endless - no more credit/debit card fees, no need to spend on POS PIN pads or contactless card readers, instant bank-to-bank payments improving cash flow and if that wasn’t enough, charitable donations will be boosted by 25% Gift Aid automatically.

As we look forward to the future of payments, we truly believe we’re at the start of a payment revolution. The PIS technology provided by Moneyhub offers a new world of possibilities that benefits all parties - almost instant payments, with no risk to the merchant and no exorbitant card fees all in a few simple steps on a mobile device, with no need to manually enter details. The innovative work we’re doing with our partners Lumio, OpenMoney, Roqqett and others is the next big step start of something very, very exciting!

Over to you . . .

If you haven't experienced the power of Open Banking then there’s no time like the present! Simply scan the QR code below and make a donation to one of the four charities we've selected to benefit directly from account to account faster payments.

Author

Dan Scholey

Dan is COO of Moneyhub, and has been heavily involved in building and delivering innovative FinTech solutions for over a decade.

Dan is passionate about helping organisations succeed through effective product strategies and has a proven track record for achieving targets, as well as managing teams to deliver products and propositions that address specific client needs.