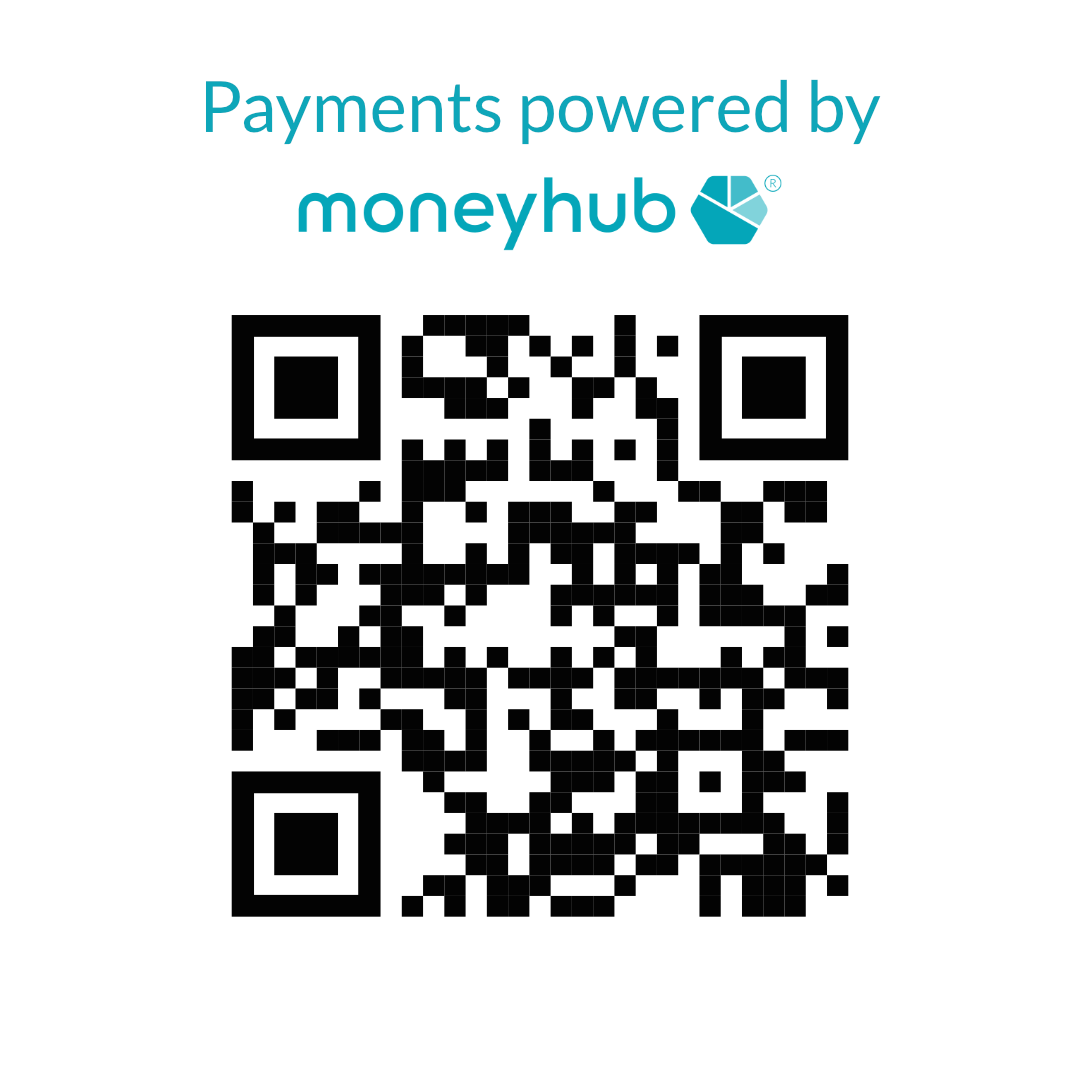

Two years ago, something pretty special happened in the world of payments. At a conference, Moneyhub COO Dan Scholey facilitated the first ever PIS Open Banking payment by a member of the public, live. Fast forward two years (almost to the day) and we’re thrilled to launch another world first with our Open Banking powered QR code payments with Gift Aid.

Every penny counts: How Open Banking can transform the charity sector

Covid-19 and the Black Lives Matter movement prompts a rise in charitable giving

The unprecedented events of the last few months has prompted huge changes in how we spend both our time, and our money. New data from our Open Finance platform reveals significant increases in one particular area of spending - charitable donations.

Data from our Open Finance platform shows consumers are spending more time at home and less time and money on trips out, clothing and shoes. Spending on clothing and shoes in particular dropped significantly, by 22% in April, 41% in May and 23% in June, compared to the same months in 2019. As Barclaycard’s research shows, consumers have instead turned to spending their money on purchases like home entertainment, ‘insperiences’ (in-home experiences), and donating to charitable causes. Our user data confirmed this, showing that donations shot up in April - June 2020, compared to the same months in 2019, as the Covid-19 pandemic and causes like the Black Lives Matter movement prompted an outpouring of support.

The stats in a nutshell:

Spending peaked in April, with 88% more going to charitable causes than in April 2019. May 2020 was up by 74%.

Total spending on charitable giving in June 2020 was 25% more than in June 2019.

This compares to February 2020, pre-lockdown, when the average spend per donation was significantly lower, only 4% up from the previous year.

Samantha Seaton, CEO of Moneyhub commented: “The coronavirus pandemic has caused us all to consider our own fortunes and has prompted a surge in support for good causes. Whether it’s giving to the NHS or those on the frontline of the crisis, or more recently rallying behind the global Black Lives Matter movement, Britons have been more inclined to do their bit and donate their extra cash. Increased charitable donations are a good sign that consumers are saving more and spending less, and therefore have more disposable income to give away.

“While this is a positive trend, we may see these transactions begin to drop as life returns to normal and people are encouraged to spend on businesses that will get the economy moving again. It’s important that people find a balance in their spending and maintain positive saving habits as we move out of the lockdown and potentially into a recession. Money management platforms that are powered by Open Finance data and intelligence can give users insight of all their finances in one place. This can help them understand the state of their finances, make more informed decisions, and ultimately build up more savings. This can help give people more financial security and allow us to carry on spending on the things that are important to us.”