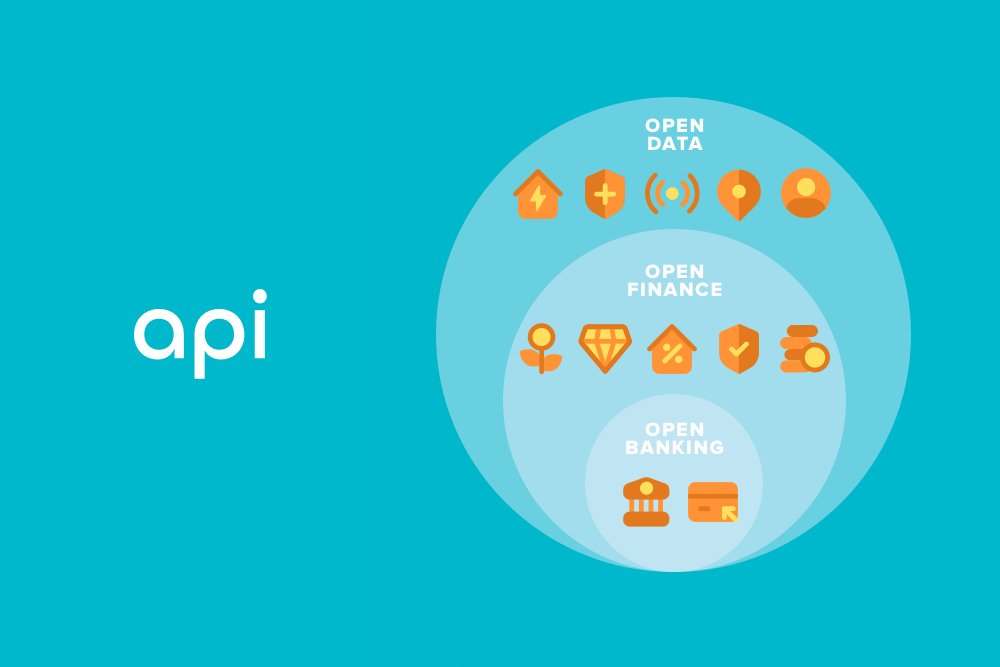

In the world of financial data, there are three key components — Open Banking, Open Finance and Open Data. These three concepts are shaping the industry’s future, with data driving the way toward transparency and holistic views. Using data in a secure, compliant, privacy-centric and authenticated way delivers significant benefits for all in the financial ecosystem, including businesses and their customers.

So, what do these terms mean, and why are they critical to shaping the future of fintech?

What is Open Banking?

Open Banking describes a process where users consent to share their banking data and transactions with third parties. It’s becoming more popular because it allows faster, more secure transactions. Open Banking democratises finance with easier access. It’s also a more mature concept with a framework for regulatory oversight.

Typically, this exchange happens through secure APIs (application programming interfaces). Some examples of it include:

Building self-service customer portals

Providing more payment options

Accelerating the opening of new accounts

Aggregating all accounts into one view

Enabling instant credit checks

Simplifying access to spending habits and other data

What is Open Finance?

Open Finance is a data-sharing model where people provide financial data from banking and other sources with third parties. Open Finance extends beyond banking and bank-based payments to pensions, investments, mortgages and other loans.

In this scenario, consumers own and control their data at all times. It’s customer-consent-centric, which means the data is authenticated and validated. Ultimately, it’s a win-win for all because access to more information drives better financial decisions. Open Finance doesn’t have regulatory guidelines as of yet.

Some examples of Open Finance include:

Tailoring and personalising added-value products for consumers

Improved accessibility and affordability around credit worthiness

Gaining easy retrieval of one’s historical transaction data

These possibilities recognise that a person’s financial footprint is much larger than banking relationships, extending to their investment activity and more.

What is Open Data?

Open Data is the sharing of data by consumers with companies to receive the most cost-effective and personalised products and services. With Open Data, a holistic view of financial data includes more than traditional sources. Digitisation and contactless payments, although convenient, create distance between people and their full financial data. Open Data helps them reconnect.

Open Data is unique and full of potential because it’s consumer-centric, offering them convenience and better solutions.

Here are two examples of how this could work:

A customer shares data with a lender to demonstrate credit worthiness.

The data can include many components like payments and non-financial information like their LinkedIn employment history profile.

The bank then has more context and can approve applications with less work.

A customer wants to buy a new car but isn’t sure which one.

The buyer can make a decision based on their full scope of data, including driving data, where they live and their financial picture.

These inputs then go through machine learning algorithms, resulting in car recommendations to suit their needs which options of where to buy them

The value of Open Data: empowering consumers and businesses

There is great value in the adoption of Open Data for all parties. This framework grows the data set to deliver more precise results, like the lender approval example. For consumers, their financial picture and well-being could be out of reach because they don’t have the whole picture.

With the adoption of this approach and the technology to support it, the benefits are massive.

Consumer benefits:

One dashboard that aggregates all financial and non-financial accounts

Highly personalised and tailored offerings

Insights on how to reduce spending and save money

Easily moving savings to other products for higher returns

Eliminating having to give personal information over and over

Paperless services

Greater oversight of all one’s income and expenses

Faster lending application approvals

Banking and lender benefits:

Accessible, holistic client view to make credit and lending decisions

Ability to segment clients into relevant and specific marketing campaigns

Leveraging hyper-personalisation as a competitive advantage

Greater potential for revenue-focused partnerships

Streamlining costs and resources across the enterprise

Acceleration of time to market for new offerings

Third-party provider benefits:

Easier access to customers and prospective ones

Complete data profiles that can drive product development

More opportunities to partner with banks and other third parties

Faster and more secure transactions

The challenges surrounding Open Banking, Open Finance and Open Data

Moving toward an open world certainly has many positives, yet challenges persist.

A top concern and barrier involve security. Consumers and businesses all have a greater awareness of cyber risk. There’s misinformation and misconceptions that cloud this topic. Regulations and sophisticated technology are in place to protect this. Nothing is 100% in data security, with the regulatory arm still catching up to innovation and the evolving role of data.

The second concern is privacy, which is somewhat different from security. There’s a push-pull here. Research says 83% of consumers are willing to share data to get more personalised experiences. On the other hand, they may have concerns about privacy and what companies do with their data.

Other issues relate to how a company can leverage it to drive results. First, you’ll need a technology platform built on Open Banking, Open Finance and Open Data. The tools that will provide this include:

Data enrichment to clean, categorise and enhance raw data, then convert it to intelligence for you and your customers

Machine learning algorithms for automated, easy, scalable and accurate categorisation

Overcoming the challenges together

These challenges no longer have to hold you back from moving toward open adoption. With Moneyhub APIs, you can build a secure, compliant, high-quality data ecosystem that can enrich and categorise. Our solutions for Open Banking, Open Finance and Open Data enable businesses to transform data into personalised digital experiences. It’s a fully customisable platform.

Where to go from here

Moneyhub goes beyond Open Banking to give you the full outlook of financial data, improving your products and your customers’ experiences.

Get in touch to discuss how you can use our APIs: Book a call with our team.

Discover how Open Finance can help you unlock mutual financial benefits for your customers and your business in our white paper →