The most wonderful time of the year?

Christmas is only a payday or two away, and many people across the UK will be feeling the financial and emotional strain.

In the run-up to Christmas, our spending habits change. The Bank of England found that the typical UK household will spend £749 more in December than in other months - a 29% increase.

But, not everyone has that cash to spare.

How do people pay for Christmas?

A 2021 study from Lowell found that the average person gets into £439 of debt over Christmas, and that it takes 4 months to get finances back into shape after the festive season.

When money.co.uk asked survey respondents how they were planning to fund their Christmas spending:

38.65% said they will use their savings

21.1% will use a credit card

5.3% will rely on loans

City A.M. recently reported that, alarmingly, UK adults are set to plunge themselves into a whopping £3.7bn worth of Buy Now Pay Later (BNPL) debt in the lead up to Christmas.

The impact of Christmas spending on mental health

The impact of Christmas spending is felt beyond someone’s bank account. It’s widely acknowledged that mental health problems can make earning and managing money more difficult, and financial difficulties such as debt can exacerbate poor mental health. This cycle can be all the more vicious through the festive period.

Skipton Building Society, who have partnered with Mental Health UK, found that 3 in 10 claim their mental health takes a ‘nosedive’ over Christmas, with affording presents and food (29%) and worry over January debt (29%) among the greatest contributors.

Accordingly, research from The Poppy Factory found that 64% of respondents cited a secure financial situation over Christmas - being able to pay for rent, water, gas and electricity bills - as the second most important factor for people with mental health conditions.

How can Financial Services help ease the burden of Christmas?

With declining cash use and the rise of easy-to-access credit solutions such as BNPL, financial services must be proactive in helping their customers manage their money, and guide them towards financial wellness.

Fortunately, through Open Finance, financial wellness solutions can be made as accessible as BNPL credit.

Moneyhub features to help your customers manage (and grow) their money

We have a suite of tools you can make available to your customers, either through our white label financial management app, or as low-code widgets to incorporate into your offering:

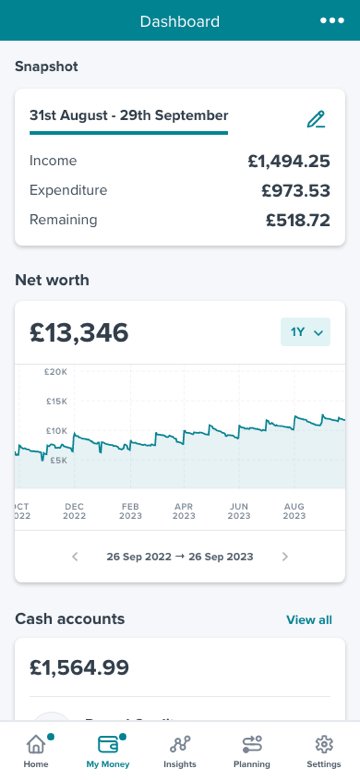

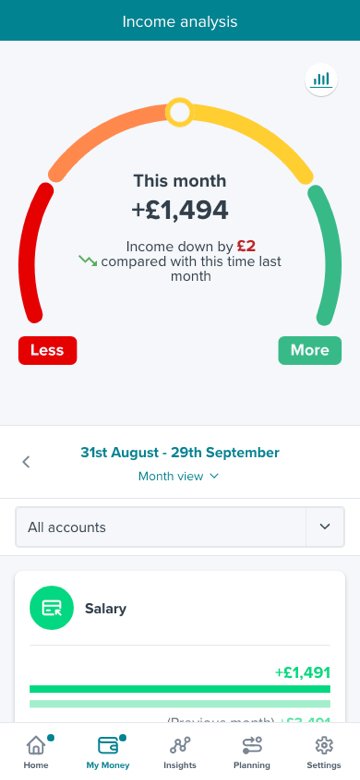

Budgets, analysis & forecasting: Give your customers an understanding of how much money is coming in, and where it’s going out, making getting the foundations of financial resilience in place as intuitive and as easy as possible.

Personal Debt Manager: Help your customers to eliminate the debt they may have built up over Christmas through a suite of features packaged up into our Personal Debt Manager - including Balance Alerts, Spend Analysis and Regular Payments.

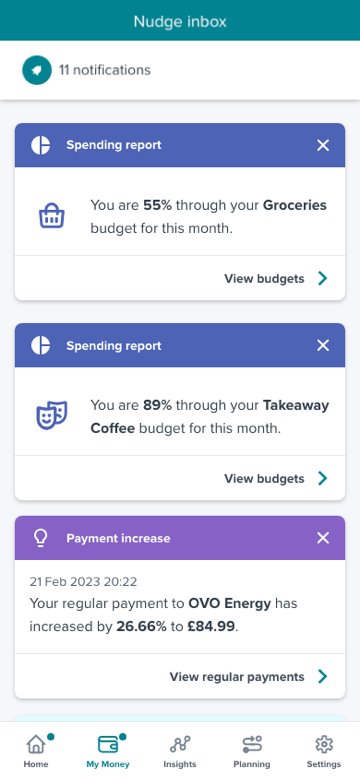

Nudges: Encourage users to take specific actions through tailored nudges based on their personal circumstances - for example; if your customer has spent £100 less than their budget on groceries in a month, you can nudge them to move that £100 into their savings account.

Embedded Credit Scores: Make credit more tangible by allowing your customers to see their credit score alongside their day-to-day finances, encouraging them to improve it or think twice before taking on more debt.

Benefits Calculator: A simple, easy to use calculator to help your users identify what extra income they may be entitled to, and guide them through application based on their income and situation - from state benefits, to charitable grants and more.

Emergency Cash Builder: Help your customers build a rainy day fund for whatever life throws at them - a broken boiler, the car needing a repair, or even their Christmas present budget - boost their financial resilience and reduce stress and anxiety.

Savings Goals: Like Emergency Cash Builder, but for the long term - you can help your customers achieve their savings goals and resilience for life’s bigger moments; a wedding, their first house or that dream Christmas holiday.

Consumer Duty compliance

We are from a range of businesses, spanning pensions, investments, banking, building societies and more, who are increasingly concerned with putting the financial wellness of their customers at the forefront of their strategy - and rightly so.

Not only is it the right thing to do, it’s near impossible to comply with the Consumer Duty regulations without being proactive in helping your customers achieve better outcomes.

Open Finance tools like our features listed above are essentially compliant by design; as well as helping your customers take control of their finances, as a firm you can gain a holistic view of their entire financial situation, covering their assets, liabilities and cash flows on an ongoing basis.

This helps create a complete picture of the financial capability and wellbeing of your customer, enabling you to better serve them with more suitable products and services, and avoid causing foreseeable harm.

Financial wellness - not just for Christmas

By encouraging your users to engage with money management tools aimed at improving their financial wellness and resilience, you can help them embed lifelong, healthy money habits. This benefits the individual, your business (as their borrowing, savings or investing potential increases) and even future generations, as they are more likely to pass these habits on to their children.

While Christmas is a time of joy and merriment for many, for a lot of people it is tainted with anxiety and worries about how they will make it through the festive season without falling into financial hardship.

Unfortunately, it’s easier than ever for people to take on unregulated credit and get further into debt through online services such as BNPL.

We need to make it just as easy and accessible for people to improve their financial situation.

Now is an ideal time for you to help your customers manage the cost of Christmas and work towards financial wellness for years to come.