2 minute read

Is your New Years’ resolution to manage your money better? It might be that you have a credit card to pay off, or you might be saving for a new car, a new house, a Dyson Airwrap™ - anything!

Starting a budget can be overwhelming. For some people, even the idea of going through all their accounts is too daunting to face which means it is often a challenge that gets pushed to the back of their minds.

See everything in one place

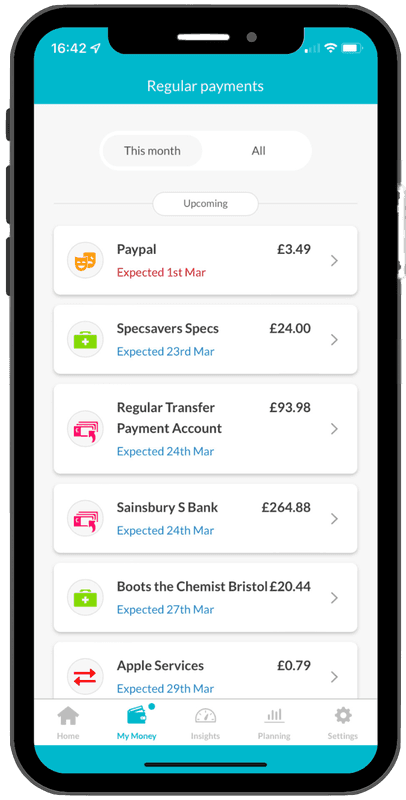

With Moneyhub, you don’t have to go through all of your statements to find out what bills are going in and out, how much you owe on your credit card or how much you are spending month to month, we will sort that all for you. All you need to do is connect all your bank accounts, savings, credit cards, investments & borrowing.

From there, you can set yourself spending goals & track your progress within the app. You might be spending £20 a week on coffee and £25 a week on lunch. By cutting down to spending £15 a week on coffee & £15 on lunch, you will save yourself £15 a week! That’s a potential £780 saving per year, that could go towards paying off your credit card or earning interest in a savings account.

We will send you nudges which will include top tips on how you can save or spend better in order to help you achieve your goals.

Spending Analysis & Custom Budgets

Do you find that you get halfway through the month, check your bank account and your balance is a lot lower than you thought it would be? Moneyhub will categorise your transactions with your Spending Analysis showing you exactly where you have been spending it. From there, you can create custom budgets to challenge yourself to only spend within a set amount. For instance, if you decide that you are going to spend £400 a month on groceries, you can track this within the app ⬇️

From here, you can understand your individual spending habits and see where you need to cut down. It’s very easy to forget how much you are spending with contactless payments being so accessible.

Other features

In addition to our spending anaylsis, custom budgets and transaction categorisation, you can also connect your property with Zoopla and connect your vehicles with Auto Trader so you can keep an eye on their value. In turn, these will add to your net worth, which is calculated by adding up everything you own (current accounts, savings, credit cards, assets), minus anything you owe (overdrafts, credit cards, loans). This figure is displayed on your Dashboard.

Get started with Moneyhub, where you will have full access to all features for 6 months, totally free! There is no auto-renewal, so after 6 months, you can choose whether you want to pay the £1.49 monthly fee or not. If not, your accounts will simply stop updating.

Security at all times

Moneyhub has bank-level authentication and robust security measures to keep your information safe at all times.