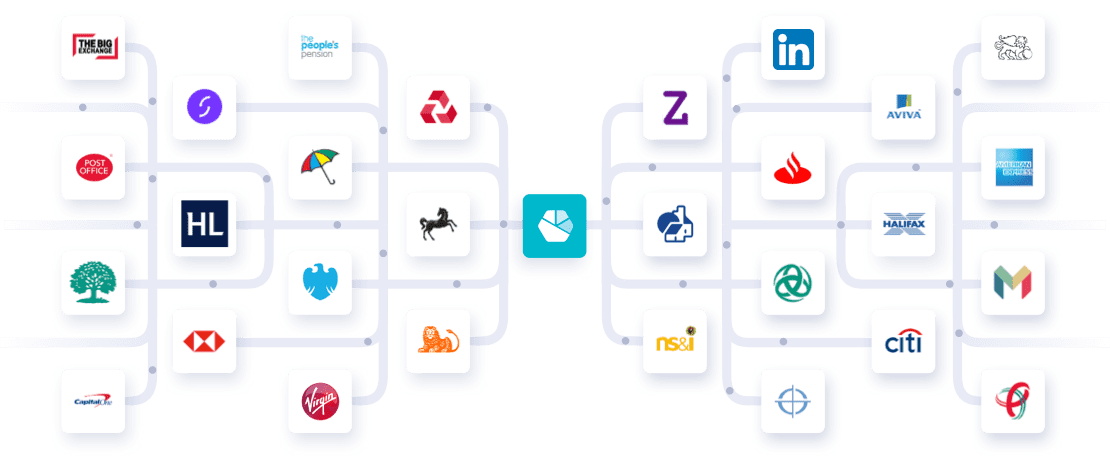

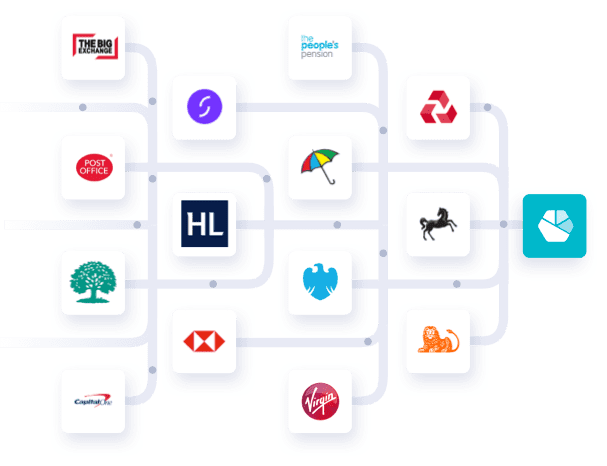

Global Open Data connections

Seamlessly connect via a single source to thousands of financial institutions in 37 countries to provide a unique and holistic view for your customers’ financial habits, needs, behaviours, and aspirations.

Benefit from a global ISO 27001 certified Open Data platform. With the most extensive range of proprietary direct connections, including but not limited to PSD2 APIs. Where screen scraping is the only method available to achieve full coverage, for example in Israel, the platform is also an aggregator of aggregators.

We can add new connections within days, so get in touch to find out more.